New Compliance Framework

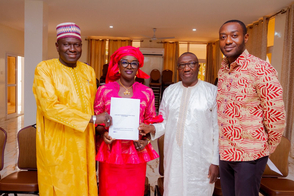

A new compliance framework has been developed, reviewed and validated by the National Association of Cooperative Credit Unions of The Gambia (NACCUG) with support from German Sparkassenstiftung Western Africa under the "Sustainable transformation of the financial sector by strengthening the credit union sector and promoting equal representation of women and youth in West Africa (regional project)".

The Compliance Framework and various evaluation tools are products of extensive consultations, consensus workshops, development and validation process by stakeholders from the credit unions, regulatory agency and other parties. This framework aims to enhance governance and ensure adherence to relevant laws.

The implementation of this framework will play a crucial role for (NACCUG) in enforcing minimum compliance standards and upholding ethical values through effective monitoring mechanisms.

Additionally:

- The framework makes it mandatory for all Credit Unions to have a woman as well as a youth representative on the board of directors of all Credit Unions in The Gambia.

- The framework recognizes the special nature of rural credit unions and has set special regulations that would encourage the compliance and growth of rural credit unions.

Following the succesful validation, a five-day training was organized for compliance officers from selected credit unions.

This training is essential for establishing effective monitoring mechanisms to check credit unions' compliance obligations and assess the extent of compliance with these obligations. The objective is to minimize exposure to reputational damage, financial loss, fines, and penalties from non-compliance in The Gambia.

The ultimate goal is to enhance governance and compliance within credit unions, thereby promoting confidence in the sector. This will assure both regulators and credit union members that sound and secure business practices are being embraced, supported by an effective monitoring mechanism.